How to Maximize Your Refund with an Online Tax Return in Australia This Year

How to Maximize Your Refund with an Online Tax Return in Australia This Year

Blog Article

Worry-free Tax Obligation Period: The Advantages of Filing Your Online Tax Return in Australia

The tax season can often really feel frustrating, yet submitting your income tax return online in Australia provides a streamlined approach that can alleviate a lot of that stress and anxiety. With easy to use platforms offered by the Australian Taxation Workplace, taxpayers take advantage of functions such as pre-filled information, which not just streamlines the process but additionally boosts accuracy. Additionally, the convenience of 24/7 accessibility enables for versatility in submission. As we explore even more, it becomes clear that the advantages prolong past simple ease-- there are engaging factors to take into consideration making the switch to electronic declaring this period.

Streamlined Declaring Refine

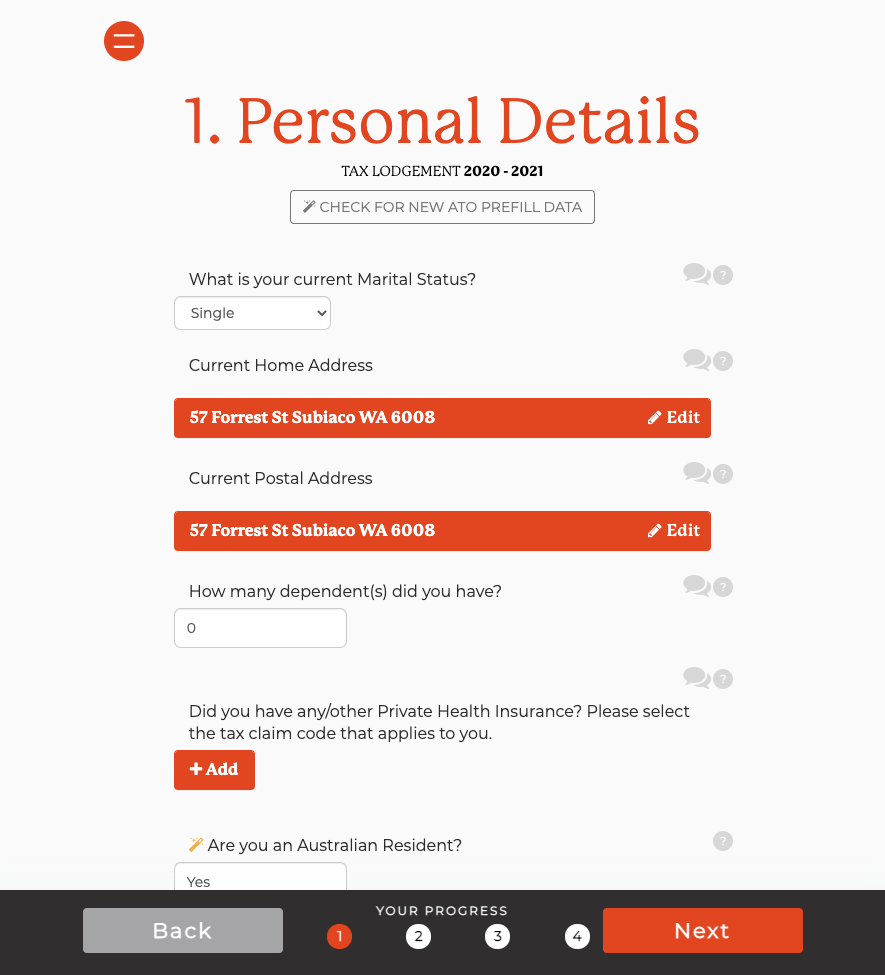

Lots of taxpayers frequently find the on the internet income tax return process in Australia to be straightforward and reliable. The Australian Taxation Workplace (ATO) has created an easy to use online platform that simplifies the filing procedure. Taxpayers can access their accounts with the ATO website or mobile app, where they are directed step-by-step with the entry procedure.

By getting rid of numerous of the intricacies associated with typical paper kinds, the on-line tax return procedure not only enhances clarity yet also encourages taxpayers to take control of their financial coverage with confidence. This streamlined declaring process is a significant innovation, making tax obligation period less discouraging for Australians.

Time-Saving Advantages

The on the internet tax return procedure in Australia not just simplifies filing yet likewise offers significant time-saving benefits for taxpayers. One of one of the most noteworthy benefits is the ability to finish the whole procedure from the convenience of one's home, eliminating the need for in-person visits with tax obligation specialists. This ease permits people to choose a time that fits their timetables, bring about increased effectiveness.

Furthermore, on-line platforms commonly give user-friendly user interfaces and detailed assistance, which assist taxpayers navigate the intricacies of tax declaring without considerable anticipation. The pre-filled info supplied by the Australian Tax Workplace (ATO) even more streamlines the procedure, enabling users to swiftly validate and update their information as opposed to starting from scratch.

One more advantage is the immediate accessibility to sources and support through online help sections and online forums, allowing taxpayers to resolve questions immediately. The ability to save development and go back to the return at any moment also adds to time performance, as customers can handle their work according to their personal commitments. Generally, the on-line income tax return system significantly reduces the time and initiative called for to satisfy tax responsibilities, making it an appealing alternative for Australian taxpayers.

Improved Accuracy

Improved precision is a significant advantage of submitting income tax return online in Australia (online tax return in Australia). The electronic systems used for on-line tax obligation submissions are designed with integrated checks and recognitions that lessen the danger of human mistake. Unlike conventional paper techniques, where hand-operated computations can cause blunders, on-line systems immediately perform computations, ensuring that numbers are proper prior to entry

In addition, lots of on the internet tax services use attributes such as data import choices from previous tax obligation returns and pre-filled information from the Australian Taxes Workplace (ATO) This assimilation not only improves the procedure yet also enhances precision by reducing the demand for hands-on information entrance. Taxpayers can cross-check their information extra effectively, dramatically lowering Visit This Link the opportunities of mistakes that might result in tax liabilities or postponed reimbursements.

In addition, on the internet tax filing systems frequently offer instant responses relating to prospective discrepancies or noninclusions. This positive approach allows taxpayers to rectify problems in real time, making sure conformity with Australian tax regulations. In summary, by selecting to submit online, individuals can take advantage of a more precise tax obligation return experience, ultimately adding to a smoother and more effective tax obligation season.

Quicker Refunds

Submitting tax obligation returns online not just boosts accuracy look at more info however additionally accelerates the refund process for Australian taxpayers. Among the significant advantages of electronic declaring is the rate at which refunds are processed. When taxpayers submit their returns online, the details is sent directly to the Australian Tax Workplace (ATO), decreasing hold-ups connected with documents handling and guidebook handling.

Typically, on the internet income tax return are refined faster than paper returns. online tax return in Australia. While paper submissions Full Report can take a number of weeks to be examined and wrapped up, digital filings often result in refunds being provided within a matter of days. This effectiveness is specifically helpful for individuals who count on their tax obligation reimbursements for essential expenditures or economic planning

Eco-Friendly Choice

Selecting on the internet tax returns presents an eco-friendly choice to typical paper-based declaring techniques. The shift to electronic procedures substantially decreases the reliance theoretically, which consequently decreases deforestation and decreases the carbon impact connected with printing, shipping, and saving paper files. In Australia, where environmental problems are progressively critical, adopting on-line tax declaring lines up with broader sustainability objectives.

Additionally, electronic entries reduce waste created from published forms and envelopes, adding to a cleaner setting. Not only do taxpayers take advantage of a much more efficient declaring procedure, however they also play an energetic role in advertising eco-conscious practices. The electronic approach enables immediate accessibility to tax papers and records, getting rid of the need for physical storage space remedies that can take in added resources.

Verdict

In conclusion, submitting income tax return online in Australia provides countless advantages, consisting of a structured process, considerable time savings, enhanced precision via pre-filled info, expedited reimbursements, and an eco-friendly technique. These attributes collectively improve the total experience for taxpayers, fostering a much more sustainable and effective approach of taking care of tax responsibilities. As electronic remedies continue to develop, the benefits of on-line declaring are likely to become progressively obvious, further encouraging taxpayers to accept this contemporary strategy.

The tax obligation period can frequently feel overwhelming, however submitting your tax obligation return online in Australia supplies a structured approach that can reduce much of that tension. Generally, the on-line tax obligation return system dramatically lowers the time and initiative called for to accomplish tax obligation commitments, making it an enticing alternative for Australian taxpayers.

In addition, many online tax obligation solutions supply attributes such as information import choices from prior tax returns and pre-filled information from the Australian Taxation Workplace (ATO) In recap, by picking to submit online, individuals can benefit from a more accurate tax obligation return experience, inevitably adding to a smoother and much more efficient tax period.

Commonly, on-line tax obligation returns are processed more promptly than paper returns.

Report this page